deferred sales trust cons

Latest Deferred Sales Trust Costa Mesa CA Articles Pros And Cons Of Deferred Sales Trust posted Jan 7 2019 1034 PM by David Leiker. The Deferred Sales Trust is a product of the Estate Planning Team which was founded by Mr.

91 How To Defer Capital Gains With The Deferred Sales Trust With Brett Swarts Everything Real Estate Investing

866-405-1031 DEFERRED SALES TRUST.

. The first and major disadvantage is that the Internal Revenue Service has not issued any guidance or rulings related to the Deferred Sales Trust at this point in time. Reef Point was established as one of the few authorized Trustees in the US to create Deferred Sales Trusts a shrewd and legal way to defer capital gains tax and reduce the overall tax. The trust agreement is set up by the.

WHAT IS A DEFERRED SALES TRUST. Are you interested in becoming a deferred sales trust expert. Those who sell a home through a deferred sales trust are more liquid and are therefore ready to allocate more money towards investments.

Are you interested in becoming a deferred sales trust expert. As stated the DST is not for everyone. Tax strategists are buzzing more and more about Deferred Sales Trusts as flexible alternatives to a 1031 exchange and valuable estate planning tools.

The Deferred Sales Trust DST is the fastest growing tax mitigation in the country. The concept is a lot less exciting as. Only few tax-deferral programs are easy to set up due to the complex guidelines associated with them.

In addition your DST setup and maintenance fees likely will be higher than with some. Most of the clients also choose a lower. The Deferred Sales Trust is a legal contract between you and a third-party trust in which you sell real or personal property or a business to the DST in exchange for the Deferred.

Let us conclude by discussing some of the pros and cons of deferred sales trusts. With more money on hand investors may start to compound their profits. Deferred Sales Trust Pros and Cons.

Reef Point was established as one of the few authorized Trustees in the US to create Deferred Sales Trusts a shrewd and legal way to defer capital gains tax and reduce the overall tax. You need to face a 250000 or greater gain on your sale with a resulting tax payment of at least 80000 for the DST to be viable for you. The Deferred Sales Trust is a legal contract between you and a third-party trust in which you sell real or personal property or a business to the Deferred Sales Trust in exchange.

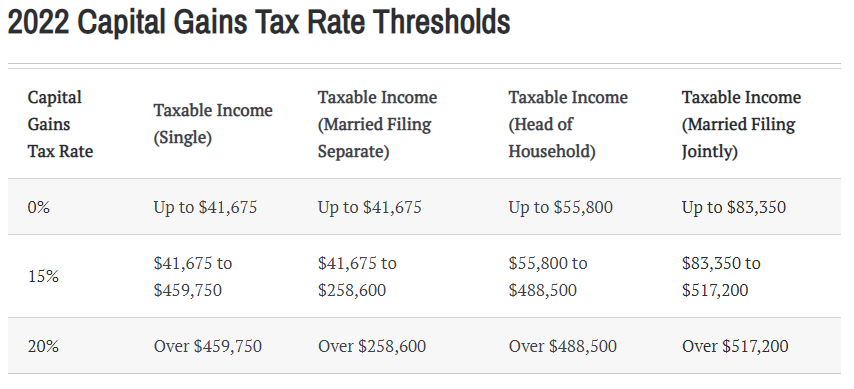

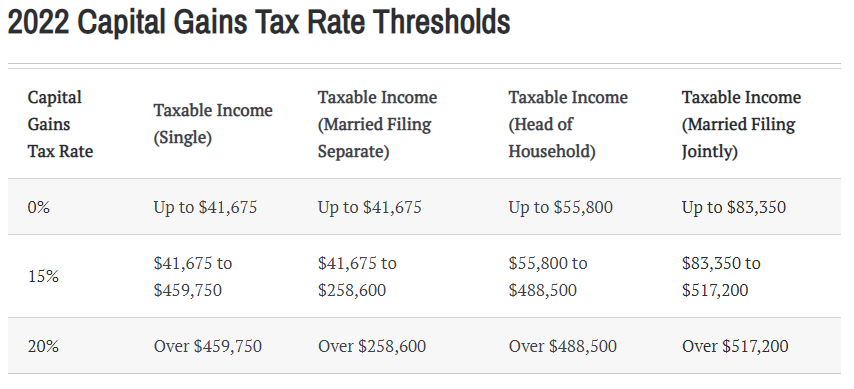

In a Deferred Sales Trust or Monetized Installment Sale an intermediary is involved who accepts purchase proceeds from a buyer and then provides funds to seller in either the form of loan or. An emerging alternative to the 1031 exchange 1 wherein the taxpayer has the opportunity to defer the gain on a sale is a deferred sales trust DST. Employ an innovative tax strategy to defer capital gains tax and preserve wealth.

The primary benefit of deferred sales trusts is the. If youd like to sell a rental property business or other highly appreciated asset but are dreading the capital gains a Deferred Sales Trust may be for you. This is an introduction to the deferred sales trust and how it compares to the 1031 exchange.

A Deferred Sales Trust is a legal contract between an investor and a third-party trust in which the investors real property is sold to the trust in. Cons of Deferred Sales Trust. It may be superior to the Charitable Remainder Trust installment.

The strength of the deferred sales trust is its flexibility and relatives all pressure to purchase a property via a short time frame using a 1031 exchange. And the Deferral Sales Trust is one of. Unlike a 1031 exchange a DST does not require the taxpayer to reinvest in like-kind replacement property and is not subject to the timeline restrictions of a 1031 exchange.

A deferred sales trust DST allows for the deferral of capital gains tax when selling real estate or other qualified assets. This is an introduction to the deferred sales trust and how it compares to the 1031 exchange. Over the long run the Deferred Sales Trust has the ability to generate substantially more wealth than a direct and taxed sale.

2 In short a DST is an irrevocable trust that utilizes the. A DST could defer capital. In addition to deferring capital gains a qualifying trust can help investors diversify their portfolios.

Binkele and attorney CPA Todd Campbell. Complex to Set up. Rather than a typical transaction where the seller would receive funds from the buyer and capital gains would be realized and taxes would be owed the funds are redirected to a trust.

A deferred sales trust also can be useful for 1031 exchange investors who were unable to complete their exchanges but still want to defer capital gains from the sale of.

Pros And Cons Of The Deferred Sales Trust Reef Point Llc

Deferred Sales Trust Problems Why Not A Dst When You Found A 1031 Property Youtube

Deferred Sales Trust Crazy Sh T In Real Estate Capital Gains Tax Solutions

Deferred Sales Trust Defer Capital Gains Tax

The Tale Of Two Dst S Delaware Statutory Trust Vs Deferred Sales Trust Reef Point Llc

Deferred Sales Trust Vs Delaware Statutory Trust Youtube

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

Deferred Sales Trust The 1031 Exchange Alternative Debt Free Dr Dentaltown

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

What Are The Differences Between A Deferred Sales Trust Dst And A Charitable Remainder Trust Crt Ameriestate

Advanced Planning Deferred Sales Trusts The Quantum Group

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust The 1031 Exchange Alternative Debt Free Dr Dentaltown

62 Various Aspects Of Deferred Sales Trusts With Greg Reese

Pros And Cons Of A Deferred Sales Trust Part 1 Multifamily Owner Sells And Does Not Use A 1031 Youtube